child tax credit september 2021 delay

It will also let parents take advantage of any increased payments they. Makes the credit fully refundable.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Increases the tax credit amount.

. Youll need to print and mail the. IR-2021-201 October 15 2021. N the 15th day of each month families across the United States are supposed to receive advance payments of their 2021 child tax credit.

The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4. CTC checks will continue to go out on the 15th of every month for the rest of 2021. SOME cash-strapped families were left waiting for their 300 stimulus check after a technical issue caused Septembers child tax credit payments to be delayed.

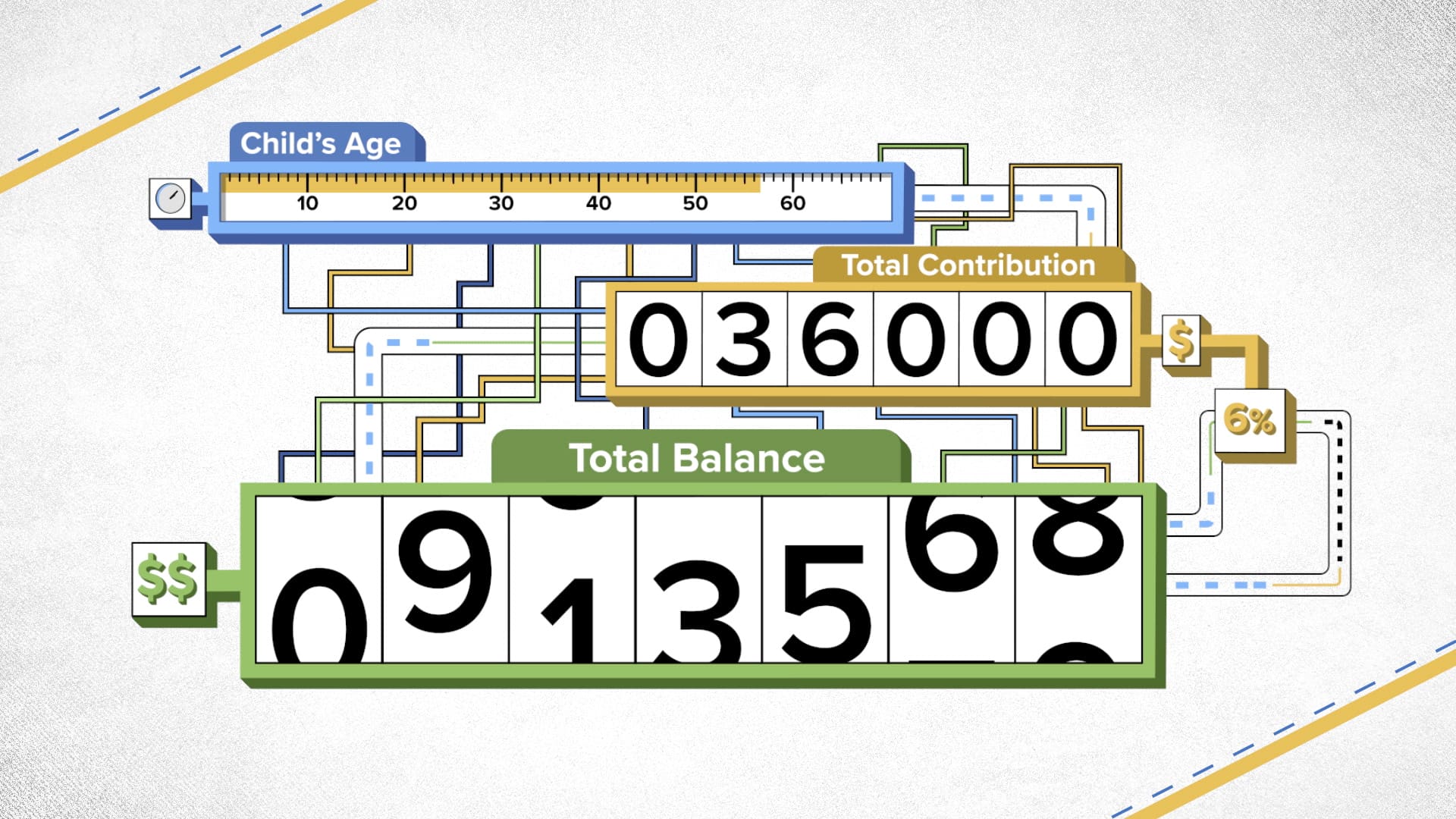

The tax credits maximum amount is 3000 per child and 3600 for children under 6. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. Even if you dont owe taxes you could get the full CTC refund.

A new program to combat child poverty authorized under the 19 trillion stimulus is at risk of facing early delays as the IRS grapples with its massive tax backlog and recent decision to extend. The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be. At first glance the steps to request a payment trace can look daunting.

Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son to land in his account by direct deposit on. Check mailed to a foreign address. Congress fails to renew the advance Child Tax Credit.

The IRS released a statement about the September delays. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Staff Report September 14 2021 1053 AM.

601 ET Sep 29 2021. About the child tax credit. The Internal Revenue Service failed to send child tax credit payments on time to 700000 households this month and some are still waiting for their full.

Removes the minimum income requirement. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat. 27 2021 1211 pm.

This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. Some families have reported issues with child tax credit payments as well as tax returns and stimulus checks. Up to 300 dollars or 250 dollars depending on age of child.

John Belfiore a father of two has not yet received the. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per. 15 some families are getting anxious that they have yet to receive the money according to a.

The monthly checks can be worth as much as 300 for each child under six years old. The September 15 checks were the third round of CTC payments and followed the first checks which went out on July 15 and will continue to go out on the 15th of every month for the rest of 2021. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

The IRS has confirmed that theyll soon allow claimants to adjust their. IR-2021-188 September 15 2021. However the IRS expected the delayed September child tax credit payments to hit bank accounts on Friday.

September 27 2021 744 AM 3 min read. Millions of American families will receive the third monthly payment from the enhanced Child Tax Credit on Wednesday. The 2021 CTC is different than before in 6 key ways.

Up to 1800 dollars or 1500 dollars depending. Some child tax credit payments delayed or less than expected IRS says. Checks were supposed to be sent out on September 15 and millions of Americans were due to receive the cash days later.

The IRS is distributing and scheduling direct deposit payments giving families 250 to 300 per child. The phase-out range for the basic 2000 child tax credit for 2021 starts at a modified adjusted gross income of 400000 for married filing jointly and 200000 for other filers. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

Including the last half of the tax credit recipients could get a total of up to 3600 per child 5 years old and younger and 3000 for every child between 6 to 17 years old. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. How important is the third round of payments from the enhanced Child Tax Credit.

Unpaid Taxes The Tax Gap House Of Lords Library

Child Tax Credit 2021 Here S When The Third Check Will Deposit Cbs News

Annual Information Statement Ais Under Income Tax Act Ebizfiling In 2021 Income Tax Income Annual

Time Is Running Out To Sign Up For Advance Child Tax Credit Checks

Tax Relief Statistics December 2021 Gov Uk

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit When Will Your September Payment Arrive Cbs Detroit

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Missing A Child Tax Credit Payment Here S How To Track It Cnet

One Week Left To Renew For 300 000 Tax Credits Customers Gov Uk

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News